Legislators may allow Clark County to raise fuel taxes without public vote

The push to extend a Clark County fuel tax that rises with inflation is moving through the Nevada Legislature for the second session in a row.

A broad coalition of supporters told lawmakers in Carson City that fuel revenue indexing — a process that adjusts the fuel tax to allow transportation funding to keep pace with rising materials and labor costs — must continue in order to keep funding road improvements.

Opponents of Assembly Bill 530 are objecting to language in the bill that allows the indexing program to continue without a vote of the people. Originally authorized in bipartisan legislation in 2013, voters extended the indexing for 10 years through a ballot question in 2016.

Before the state implemented fuel revenue indexing, drivers in Southern Nevada paid 52 cents per gallon in fuel taxes. By the time voters chose to extend the indexing plan, they were paying 62 cents per gallon. Currently, drivers pay 75 cents per gallon, which includes 23 cents per gallon collected through indexing.

The indexed portion of fuel tax can go up by no more than 4 cents per gallon per year, according to the Regional Transportation Commission of Southern Nevada. Last year, it went up 2.9 cents.

Revenue generated by the fuel tax is shared by the county, state, federal government and the RTC. Fuel revenue indexing was expected to generate $160 million for the 2025 fiscal year, or about 14 percent of the transportation agency’s budget.

Fuel revenue indexing is set to expire in 2026. If AB 530 doesn’t pass, the last fuel revenue index adjustment made in 2026 would stay in place.

Backers: Program helps prevent shortfall

Transportation commission officials say extending the indexing program helps avoid a severe funding shortfall. Since fuel revenue indexing’s inception in 2014, it has generated more than $1 billion to help fund 702 projects, about 70 percent of which have been completed, said David Swallow, deputy chief executive officer of RTC.

“By having this mechanism in place, we’re trying to keep the value of the dollar commensurate with the cost of construction,” Swallow said. “it’s not meant to be this big tax increase that supports a large program. It’s more of, let’s stay with the cost of construction and maintenance.”

RTC officials estimate if fuel revenue indexing is not extended, they could have to cut annual road maintenance program spending from between $200 to $300 million to around $100 million. Swallow said that is because the agency uses bonds to help fund road projects. RTC is expected to reach the limit of its bonding capacity by 2028 or 2029, meaning future projects would be limited to “pay as you go,” limiting the agency to the funds they have on hand.

Swallow said the fuel revenue indexing also helps regional transportation authorities apply for competitive federal grants by having local matching funds available.

The transportation commission — as well as local governments, chambers of commerce, the Nevada Resort Association and others — are calling on the Legislature to extend the practice for another 10 years if the Clark County Board of Commissioners approves it with a two-thirds majority vote.

The effort appears to be gaining momentum. The Nevada Assembly approved the bill 39-3 before the first House passage deadline in April, with only Republicans Jill Dickman, of Sparks; Danielle Gallant, of Las Vegas; and minority floor leader Gregory Hafen, of Pahrump voting against.

‘Hidden hikes’ at issue

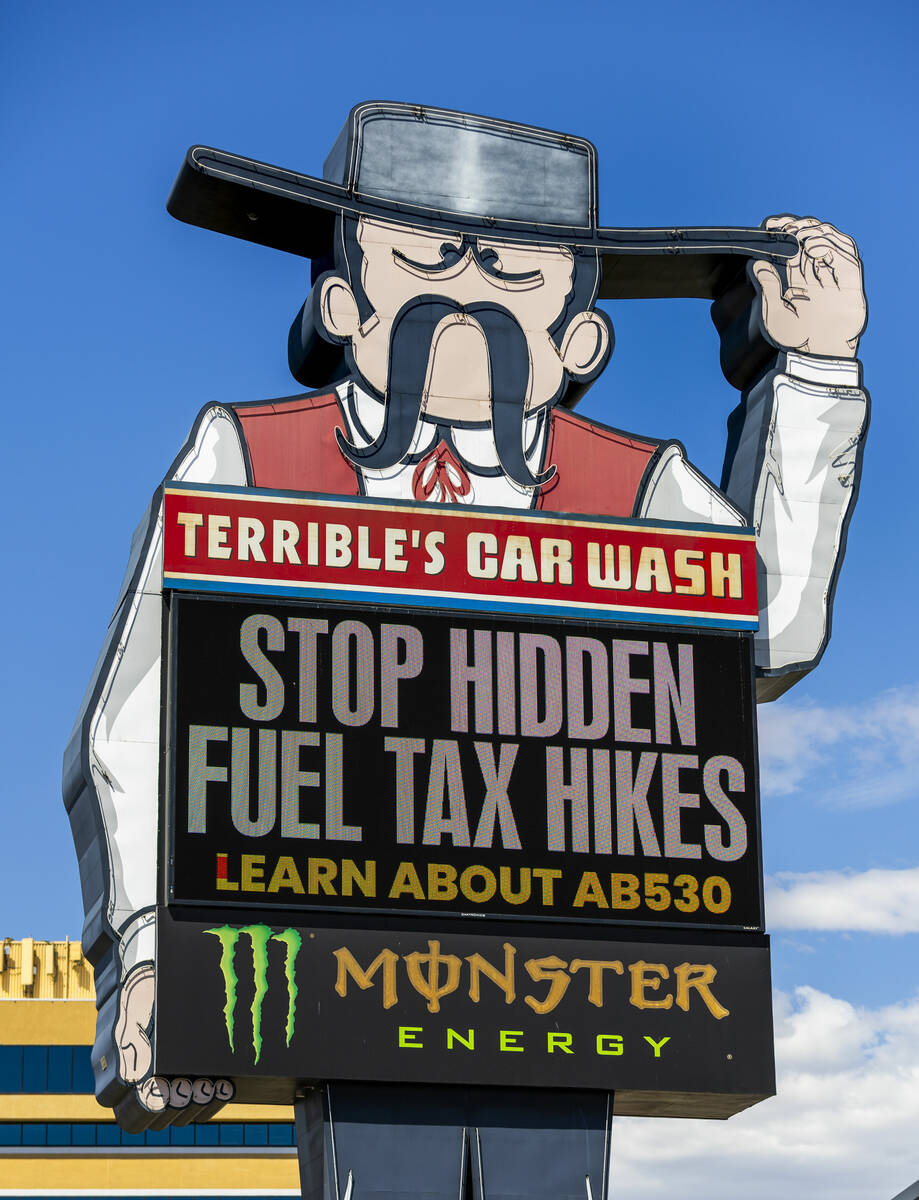

Some opponents argue the bill is effectively a tax increase — including a visible campaign by gas station chain Terrible’s, which has used digital billboards, gas station pumps and its website to sway public opinion. Terrible Herbst Inc. did not respond to a request for comment.

Opponents also say AB 530 skirts the public’s authority to continue a voter-approved tax — something that some lawmakers are having to balance as they consider the bill. During a work session in the state Senate, Carrie Buck, R-Henderson, voted against recommending the bill but said she “reserved her right” to change her vote on the floor.

Buck said her constituents are concerned that a voter-approved tax that might continue past its original end date. She hoped to “convince them that this is for the betterment of Nevada,” she said before the Friday work session vote.

Republican Gov. Joe Lombardo vetoed a similar extension on fuel revenue indexing in 2023, when he set a record with 75 vetoes for one session. In his veto letter, Lombardo said he found the method of the extension “concerning.”

“The arguments in favor of fuel revenue indexing are compelling, but a decision on this issue, which impacts household budgets every day, is most appropriately rendered by the voters,” Lombardo wrote in June 2023.

AB 530 is largely the same language as the previous bill, but this version would require the question to return to voters in 2036.

Anahit Baghshetsyan, a research assistant for the libertarian-leaning think tank Nevada Policy Research Institute, framed the issue as going against taxpayer’s rights by avoiding a direct democracy vote.

“While maintaining roads and improving infrastructure undoubtedly is a major goal for the Silver State, it should not be done at the sake of the voters and the state’s election integrity,” she said Wednesday during the Senate Committee on Growth and Infrastructure.

A similar tax extension effort moving through the Legislature, Senate Bill 451, would allow local governments to extend a voter-approved tax that funds about 800 Metropolitan Police Department positions. That bill requires a two-thirds majority vote of the Legislature.

The county Board of Commissioners and Las Vegas City Council already approved a resolution to support SB 451 in votes on April 19 and 21, respectively.

Contact McKenna Ross at [email protected]. Follow @mckenna_ross_ on X.